Rebuilding America’s aging infrastructure is one task that most economists and civil engineers, and most Americans, agree should be at or near the top of President Donald Trump’s agenda. President Trump touted his background as a real estate developer to convince voters that he was best positioned to identify priorities and bring various interest groups together to structure concrete solutions. If he can harness bipartisan support for fixing or upgrading roads, bridges, tunnels, railways, airports, dams and other critical infrastructure, while satisfying Congressional budget hawks, he will fulfill one of his most consequential campaign promises. However, the just announced Trump Tax-Cut Plan, while light on technical detail, would almost certainly enlarge the budget deficit and will complicate any legislative push for infrastructure funding.

Rebuilding America’s aging infrastructure is one task that most economists and civil engineers, and most Americans, agree should be at or near the top of President Donald Trump’s agenda. President Trump touted his background as a real estate developer to convince voters that he was best positioned to identify priorities and bring various interest groups together to structure concrete solutions. If he can harness bipartisan support for fixing or upgrading roads, bridges, tunnels, railways, airports, dams and other critical infrastructure, while satisfying Congressional budget hawks, he will fulfill one of his most consequential campaign promises. However, the just announced Trump Tax-Cut Plan, while light on technical detail, would almost certainly enlarge the budget deficit and will complicate any legislative push for infrastructure funding.

Articles Posted in Infrastructure

Contingencies in Construction Budgets: Lenders’ and Borrowers’ Perspectives

As any builder will tell you, it is impossible to know with certainty the exact amount a project is going to cost. Variables affecting the cost run the gamut from labor and material costs to delays for unforeseen conditions, weather or other causes. The longer a project is expected to take, the more uncertain the project’s costs become. For this reason, contingencies are included in budgets by all parties involved: owners, contractors, subcontractors and, occasionally, lenders. Ideally, these contingencies will allow the project to absorb delays and other unexpected events without the owner being forced to contribute additional equity (and “balance the loan”) at the time. The owner will desire maximum flexibility over the re-allocation of the contingency(ies) to line items that will then be funded by the lender—while the lender will want to “control” the use of contingency line items to the extent possible.

With this in mind, let’s look at some of the competing motivations at play and “typical” loan agreement provisions regarding the use (or re-allocation) of contingency(ies) to other line items in the Project Budget.

Eminent Domain in California – What You Should Know and What You Can Do BEFORE the Government Comes to Take Your Property

Public development and infrastructure projects are on the rise in California. This is a good thing for the economy.  But it also means that private property will often be needed to complete these projects. Public agencies may acquire private property upon payment of just compensation, without the owner’s consent, through an eminent domain action. Property near highways, railroads, public utilities, government buildings and other public facilities are frequent acquisition targets for expansion of these facilities, as are those properties in the path of development of growing cities. But virtually any property may be subject to public acquisition, either through condemnation of the entire property or of easements in the property.

But it also means that private property will often be needed to complete these projects. Public agencies may acquire private property upon payment of just compensation, without the owner’s consent, through an eminent domain action. Property near highways, railroads, public utilities, government buildings and other public facilities are frequent acquisition targets for expansion of these facilities, as are those properties in the path of development of growing cities. But virtually any property may be subject to public acquisition, either through condemnation of the entire property or of easements in the property.

Water Bill to Boost Public-Private Partnerships

We have previously written regarding critical repairs and updates needed for the Nation’s aging infrastructure. We have also noted the need for private investment to get these capital-intensive infrastructure projects off the ground. An Act recently passed with strong bipartisan support by Congress and expected to be signed into law as early as this week by President Obama seeks to promote private investment in water infrastructure projects through innovative financing programs and the use of public-private partnerships (“P3s”).

The Water Resources Reform and Development Act of 2014 (“WRRDA”) (H.R. 3080) establishes a five-year pilot program – the Water Infrastructure Finance and Innovation Act (“WIFIA”) – which provides low-interest federal loans and loan guarantees for major water infrastructure projects. WIFIA authorizes the Army Corps of Engineers and the Environmental Protection Agency to provide up to $175 million in direct loans and loan guarantees for the construction of critical water infrastructure projects, including those delivered through P3s. WIFIA is modeled after the Department of Transportation’s Transportation Infrastructure Finance and Innovation Act, a successful federal program which has supported major P3 transportation projects.

In addition, WRRDA creates a separate 15-project pilot program – the Water Infrastructure Public-Private Partnership Program – to assess the use of P3s to accelerate projects in such areas as hurricane, storm, and flood damage reduction; coastal harbor improvement; and aquatic ecosystem restoration. These pilot projects authorize the Army Corps of Engineers to enter into agreements with private entities and state and local governments to help address a significant project backlog.

It is estimated that the U.S. water and sewer infrastructure will need an investment of between $600 billion and $1 trillion in the coming decades. Given the magnitude of capital needed and the critical nature of these projects, P3s seem to be an ideal structure for accomplishing the work, particularly given the current financial pressures faced by the government and its agencies. If WRRDA and its programs prove successful, it makes sense to expand such financing programs and encourage the use of P3s to fund projects addressing other sectors of the Nation’s infrastructure.

Hallmarks of Infrastructure Success

Enhancing the quality of life and economic opportunity in any region will require investments in social infrastructure–facilities for civic life, health care, education, and social services–as well as transportation infrastructure–transit, highways, surface streets, and parking. These projects entail considerable risks in design, approval, and execution, and must compete with investments elsewhere in the public and private sectors. Attracting economic and political support of all types for infrastructure will be critical to achieving the region’s potential.

In this article, reprinted with permission from the Bay Area Council Economic Institute, Pillsbury Partner Rob James identifies the hallmarks of projects that tend to realize the greatest success in navigating the risks and meeting the competition.

Building Around Nature – Literally

Construction is set to begin in April on a highway bypass south of College Station, Texas. But a group of ancient oak trees sits near the site where the road will run. The Texas Department of Transportation (“TxDOT”) intended to remove four of the trees, each 200 to 300 years old, which stood in the way of the planned bypass. And the safety of the nearby trees, including a massive 500 year-old oak tree thought to be one of the oldest trees in Texas, could not be guaranteed.

But community outcry has forced the TxDOT to reassess. For nearly 150 years, Regina McCurdy and her family have owned the land on which the ancient oak trees sit. The last 7 of those years, she and her family have been fighting with the TxDOT to save the trees.

It appears their pleas in favor of nature were finally heard. Last week, the TxDOT decided to redesign the road. The new design will use a narrower median to allow the road to be built around the oak trees. According to John Barton, TxDOT Deputy Director, it is an “urban design in a rural setting.” Additionally, an arborist will monitor the trees during the construction process to ensure their survival.

Now THAT is sustainable design.

California’s High Speed Rail Inches Toward Construction

Since we last checked in on California’s planned high speed rail system nearly a year ago, it has continued to take baby steps toward construction.

Mike Rosenberg of the San Jose Mercury News notes here that on June 6 the California High Speed Rail Authority’s (CHSRA) board authorized its CEO to negotiate final terms of a contract for the first phase of construction with a Tutor Perini-led group after its $985 million bid beat its nearest competitor by about $100 million and the initial estimate by over $200 million.

The project also avoided a potential roadblock with the June 13, 2013 decision of the federal Surface Transportation Board (STB) to grant the CHSRA an exemption allowing it to proceed with construction without subjecting itself to the STB’s approval requirements in addition to the hurdles already cleared. The STB’s decision, effective June 28 according to its text, is available here.

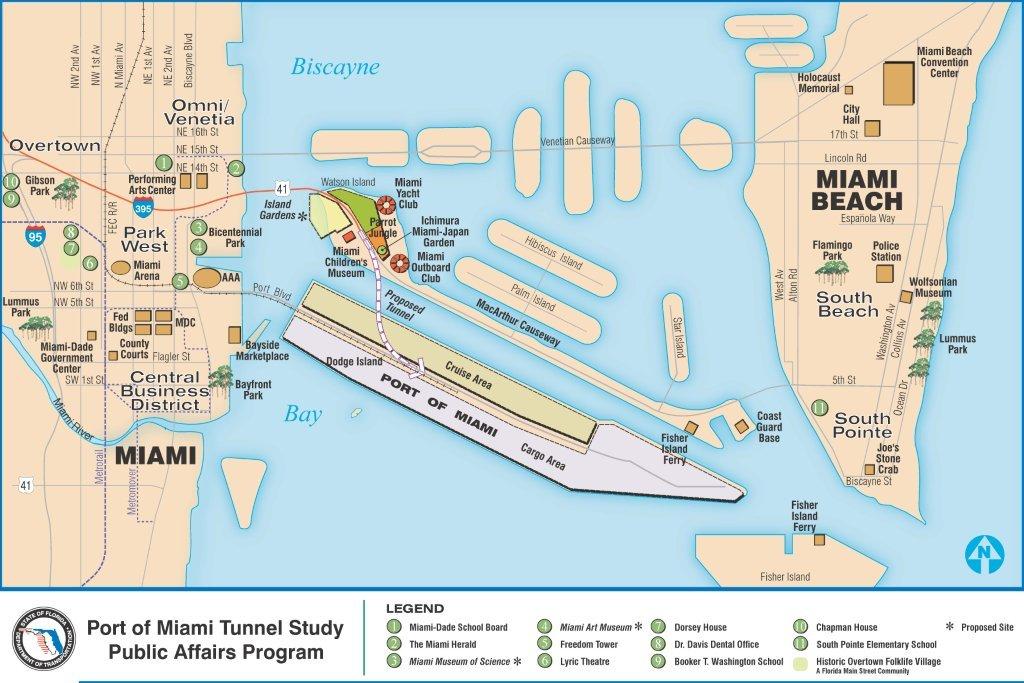

Light at the End of the (PortMiami) Tunnel – Harriet Reaches Watson Island

THE ANSWER: The Port of Miami Tunnel (POMT) – a $1 billion tunnel connecting I-395 to the Port of Miami.

THE DILEMMA: How exactly does one build a tunnel (twin tunnels actually) approximately 4,2000 feet long, almost 40 feet in diameter, and 120 feet below the surface of the water?

Enter “Harriet” – the $45 million German-built Tunnel Boring Machine (TBM) that has spent the past 18 months digging through the earth near Miami, leaving twin tunnels in her wake. The massive TBM that would build this underground network was aptly named, by the Miami-Dade County Girl Scouts, after Harriet Tubman.

Harriet was built and tested by Herrenknecht in Germany, then disassembled and packed for her transatlantic voyage to the U.S. in the Summer of 2011. Harriet is the largest diameter soft ground tunnel boring machine in the United States. In an assembled state, she is 428.5 feet long and her cutter head has an outside diameter of 42.3 feet. That’s longer than a football field and as high as a 4 story building.

The process for excavating and building the twin tunnels is not an easy one – even for Harriet. The “Tunneling Process” is described as follows:

The cutter head rotates as a cutting wheel boring out the underground area, while the trailing gear contains the electrical, mechanical, guidance systems and additional support equipment. Excavated material is carried back through the trailing gear on an enclosed conveyor belt and deposited outside the tunnel entrance, or portal. It is moved off‐site to be used as fill material and is disposed in a manner consistent with applicable environmental rules and regulations. As the TBM moves forward it erects precast concrete liners (known as segments) that become the finished wall of the tunnel. Once the liners are in place, grout is pumped into the space between it and the excavated area to fill any voids or gaps.

And about those “segments” that become the finished wall of the tunnel – it takes 8 segments to construct each ring and Harriet can construct 3-6 rings per day. According to the POMT website, “Harriet launched from her home in the Watson Island pit on November 11, 2011, boring the first tunnel towards Dodge Island. Harriet emerged on Dodge Island on July 31, 2012 where she was disassembled, turned and reassembled.” EarthCam captured Harriet’s breakthrough on Dodge Island on video.

Yesterday, May 6, 2013, Harriet reached the end of her journey. After working 24 hours a day (with 4 hours being for daily maintenance) with up to 30 people inside and on the machine’s surface – Harriet has finally reached the light at the end of the tunnel. To quote Chris Hodgkins, V.P. of Miami Access Tunnel: “She’s dirty, she’s worn, she’s missing a lot of her teeth. She wants to breathe some fresh air. She served us well, and she’s ready to call it a day.”

The Port of Miami Tunnel is expected to open to traffic in May 2014. For more information, visit the Port of Miami Tunnel website.

Who’s picking up good vibrations?

Don’t worry. That shaking you feel isn’t an earthquake. It’s the construction of the new Tappan Zee bridge across the Hudson River north of New York. I’m kidding of course. Construction on the $3.9 billion project hasn’t even started yet, but much of the geotechnical work, not to mention the design, has. Now they are planning on picking up good vibrations with highly sophisticated shoebox-sized sensors posted around the construction site. This is nothing new, but the plan to make the data available online 24/7 is–at least as far as I know. Check back here in a few weeks to see the monitoring page.

Don’t worry. That shaking you feel isn’t an earthquake. It’s the construction of the new Tappan Zee bridge across the Hudson River north of New York. I’m kidding of course. Construction on the $3.9 billion project hasn’t even started yet, but much of the geotechnical work, not to mention the design, has. Now they are planning on picking up good vibrations with highly sophisticated shoebox-sized sensors posted around the construction site. This is nothing new, but the plan to make the data available online 24/7 is–at least as far as I know. Check back here in a few weeks to see the monitoring page.

But lest you think that the only people interested in the movers and shakers at the bridge are the contractor and the nimbies and gadflies nearby, note this: Columbia University’s Lamont-Doherty Earth Obversvatory is just downriver on the West side, home to gobs of the largest and most sophisticated earth measuring equipment you’ll find. My geotechnical engineer friends tell me that every year Lamont-Doherty hosts an open house, which is generally geared toward kids, but is fascinating for geeks (like me) of all ages. It’s usually in early October, so check their website if you’re anywhere near New York and take the kids. While you’re there you can swing by and see a pretty cool construction site at the new bridge.

P3s and America’s Ports

In a previous post, we reported that the American Society of Civil Engineers (“ASCE”) released its 2013 Report Card for America’s Infrastructure. America’s cumulative GPA for infrastructure was a D+. One of the categories in this report focused on ports, which received a C grade. Now a new report goes into more depth on one particular part of our infrastructure: Ports. The question, it seems, is: CapEx or Capsize. More, after the jump.

ASCE reported that, according to U.S. Army Corps of Engineers estimates, more than 95% of the volume of overseas trade imported or exported by the United States moves through our ports. The report stressed the importance of improving our nation’s ports in order for the nation to maintain its competitive edge in the global economy: “To sustain and serve a growing economy and compete internationally, our nation’s ports need to be maintained, modernized, and expanded. While port authorities and their private sector partners have planned over $46 billion in capital improvements from now until 2016, federal funding has declined for navigable waterways and landside freight connections needed to move goods to and from the ports.” The inability of the federal government and state governments to fund the necessary improvements to our ports makes a strong case again for the importance of public-private partnerships (“P3s”) in improving our country’s infrastructure.

According to the recent North American Port Analysis report, published by Colliers International in April, America must secure $3.6 trillion in funding by 2020 for the country’s infrastructure in order to improve U.S. ports and to stay competitive in the global market. This is especially true since, as stated in the report, the Panama Canal Expansion is altering global trade patterns, and major trade is shifting from Asia to Latin America, and from America’s West Coast to East Coast/Gulf ports. In subtitling the report CapEx or Capsize, the economists for Colliers International are driving home the importance of investing in the nation’s infrastructure and ports now rather than delay such an essential undertaking. P3s will definitely contribute to this investment.

As exemplified by past projects, ports can greatly benefit from P3s. One example of a very successful P3 project was the 2004 expansion of the Port of Galveston in Galveston, Texas. The Port of Galveston Cruise Terminal Development (the “Project”) was a partnership between the Port of Galveston and several private partners, including CH2M Hill, Royal Caribbean International and Carnival Cruise Lines. In 2002, the private partners submitted an unsolicited proposal to expand the cruise ship services and facilities. The public and private sectors then worked together to fund the project and to provide the necessary facilities on time and within budget. The Port of Galveston benefited from the project because of the increased revenue from growth in related employment and commercial revenues. And the private partners benefited because a greater number of their cruise ships can now utilize the improved port to increase customers and revenues.

On the whole, like many P3 projects, it was a win for both sides. The National Council for Public-Private Partnerships awarded the Project the 2004 NCPPP Infrastructure Award Winner. A more detailed description of this exemplary project can be found here.

Overall, P3s can play a vital role in improving our nation’s infrastructure and assisting our nation to secure the $3.6 trillion necessary to raise our infrastructure GPA from a D+ to a B. P3 projects have proven time and time again that they can be much more efficient and can lower costs. This certainly is a winning combination to turn around our nation’s infrastructure.

Gravel2Gavel Construction & Real Estate Law Blog

Gravel2Gavel Construction & Real Estate Law Blog