Blockchain technology is a digitized, distributed ledger that immutably records and shares information using software protocols and advanced cryptology. The development of blockchain-based smart contracts—self-executing software algorithms integrated into a blockchain with trigger actions based on pre-defined parameters—has made it possible for parties to automate the process of executing commercial transactions between counterparties in a more direct, trustworthy and efficient manner.

Blockchain technology is a digitized, distributed ledger that immutably records and shares information using software protocols and advanced cryptology. The development of blockchain-based smart contracts—self-executing software algorithms integrated into a blockchain with trigger actions based on pre-defined parameters—has made it possible for parties to automate the process of executing commercial transactions between counterparties in a more direct, trustworthy and efficient manner.

Articles Posted in Real Estate

The Looming Housing Crisis and Limited Government Relief—An Examination of the CDC Eviction Moratorium Two Months In

Months after the Centers for Disease Control and Prevention (CDC) issued a nationwide eviction moratorium using its emergency pandemic powers under the Public Health Service Act, the efficacy of this unprecedented measure remains unclear. While the Order ostensibly protects tenants facing homelessness or housing insecurity due to the financial impacts of the COVID-19 pandemic through the end of 2020, legal challenges have been initiated in Ohio and Georgia, with additional lawsuits appearing likely. Further, even barring legal challenges, courts have not handled these cases in a uniform manner. With lawmakers unable to reach any stimulus or COVID-19 relief agreement before the election, the CDC Order appears likely to remain the only federal eviction moratorium through its expiration on December 31, 2020.

Months after the Centers for Disease Control and Prevention (CDC) issued a nationwide eviction moratorium using its emergency pandemic powers under the Public Health Service Act, the efficacy of this unprecedented measure remains unclear. While the Order ostensibly protects tenants facing homelessness or housing insecurity due to the financial impacts of the COVID-19 pandemic through the end of 2020, legal challenges have been initiated in Ohio and Georgia, with additional lawsuits appearing likely. Further, even barring legal challenges, courts have not handled these cases in a uniform manner. With lawmakers unable to reach any stimulus or COVID-19 relief agreement before the election, the CDC Order appears likely to remain the only federal eviction moratorium through its expiration on December 31, 2020.

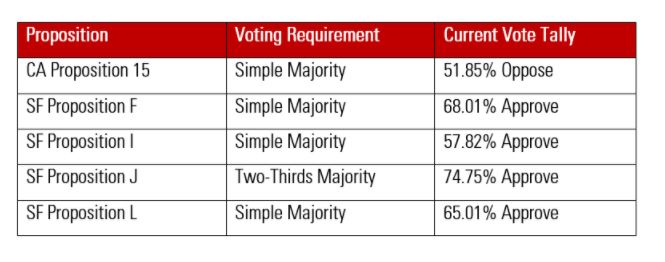

California’s Proposition 15 Is Failing While San Francisco Accepts a Bevy of Local Tax Measures

California voters say “No” to split roll, and San Francisco voters say “Yes” to higher gross receipts taxes and real estate transfer taxes.  In “California’s Proposition 15 Is Failing While San Francisco Accepts a Bevy of Local Tax Measures“, colleagues Craig A. Becker, Breann E. Robowski, William L. Bennett discuss that California and San Francisco voters were asked to decide several tax‑related referenda with major implications across all business industries. Although it is too early to state with certainty, voters appear to have rejected Proposition 15, a measure that would introduce a so-called “split roll” property tax system. On the same day, voters in San Francisco overwhelmingly approved a battery of tax-related measures: Proposition F, which overhauls San Francisco’s business taxes; Proposition I, which doubles the real estate transfer tax on transactions exceeding $10 million; Proposition L, which institutes an aggressive new “Overpaid Executive Gross Receipts Tax;” and Proposition J, which repeals and replaces an annual parcel tax.

In “California’s Proposition 15 Is Failing While San Francisco Accepts a Bevy of Local Tax Measures“, colleagues Craig A. Becker, Breann E. Robowski, William L. Bennett discuss that California and San Francisco voters were asked to decide several tax‑related referenda with major implications across all business industries. Although it is too early to state with certainty, voters appear to have rejected Proposition 15, a measure that would introduce a so-called “split roll” property tax system. On the same day, voters in San Francisco overwhelmingly approved a battery of tax-related measures: Proposition F, which overhauls San Francisco’s business taxes; Proposition I, which doubles the real estate transfer tax on transactions exceeding $10 million; Proposition L, which institutes an aggressive new “Overpaid Executive Gross Receipts Tax;” and Proposition J, which repeals and replaces an annual parcel tax.

Real Estate Market Update

In episode #22 of Industry Insights podcast, Bob Grados joins host Joel Simon to discuss the current real estate market, the types of lenders active in the market and popular transaction types that are thriving in today’s environment.

Joel Simon: There’s been so much published and discussed about real estate in the current market environment, but today I’d like to talk about lenders and, more specifically, different types of lenders. One of the more interesting aspects of your practice, Bob, is that you work on real estate finance transactions that often feature different types of lenders with different stakes in the same asset or group of assets. Can you give us an idea of the number and variety of lenders you come across? Continue Reading ›

Mezzanine Loans Behind Construction Loans—Special Considerations and Intercreditor Agreement Provisions

An intercreditor agreement (ICA) involving a construction loan raises a host of complicated and unique issues that are not addressed in the typical ICA. As more fully described in the prior alert on Intercreditor Agreements (ICAs), and by way of a short introduction to mezzanine loans generally, the mezzanine lender in a single mezzanine loan structure makes a mezzanine loan to the mortgage borrower’s owner(s) (the “mezzanine borrower”) and the mezzanine loan is secured by the mezzanine borrower’s equity interest in the mortgage borrower (a single purpose entity that is not the property owner entity). In “Distressed Real Estate During COVID-19: Mezzanine Loans Behind Construction Loans—Special Considerations and Intercreditor Agreement Provisions”, colleagues Caroline A. Harcourt and Paul Shapses discuss that construction loans with companion mezzanine loans raise a host of concerns that are unique to more standard ICAs between a mortgage lender and a mezzanine lender.

Join Us 11.12 for an Energy Transition Virtual Fireside Chat with Paul Browning

Pillsbury partner and Global Co-Head of the Energy & Infrastructure Projects team, Mona Dajani, talks #ChangeInPower with Paul Browning, President and CEO of Mitsubishi Power Americas.

Join us on November 12, 2020, for a 45-minute conversation, where Mona and Paul discuss the power sector’s role in the energy transition, the growing prominence of hydrogen and energy storage, collaborating with customers and stakeholders and setting a path toward a decarbonization of the power grid.

To attend this exclusive fireside chat, register here.

The Role of Intercreditor Agreements between Mortgage Lenders and Mezzanine Lenders

Mortgage lenders and mezzanine lenders considering amendments to loan documents, forbearance, loan transfers, the exercise of remedies or deeds in lieu of foreclosure, and other loan-related fact patterns will need to revisit and comply with the provisions of their respective ICAs. In “Distressed Real Estate During COVID-19: The Role of Intercreditor Agreements between Mortgage Lenders and Mezzanine Lenders“, colleague Caroline A. Harcourt discusses how the current distressed real estate environment will put many of these arrangements to the test.

Real Estate Trends: Looking Ahead to 2021

2020 has been an unprecedented year, and, while there are likely more twists and turns to come before December 31, it is essential to look at how the real estate markets have changed this year and which trends are likely to continue into 2021. The COVID-19 pandemic has impacted nearly every industry, including commercial real estate, and its impact will continue to influence the market and commercial real estate long after the virus has been eradicated.

Hotels & Hospitality: Opportunities, New Strategies and Future Transformation

In episode 17 of Industry Insights podcast, host Joel Simon and Christian Salaman discussed the changes the hotel and hospitality industry are undergoing.

In episode 17 of Industry Insights podcast, host Joel Simon and Christian Salaman discussed the changes the hotel and hospitality industry are undergoing.

Joel Simon: Christian, you have a really great practice with an emphasis on two industries, one of which seems relatively insulated by the unusual circumstances we’re facing today and the other which has been rocked pretty hard. It’s the second one I’d like to focus on today. Can you start us off with a brief discussion of the status of the hotel business and what a recovery might look like for that sector?

Trump Administration Announces New Eviction Moratorium

With the financial impacts of the COVID-19 pandemic continuing to be felt by the American public, the Trump Administration has taken steps to try to allay a coming eviction crisis by enacting a moratorium on evictions through the end of 2020. With the first eviction moratorium instituted by the CARES Act expiring, lawmakers have been pushing to include eviction protections in the next COVID-19 relief package. However, with Congressional leaders still far from an agreement on the next bill, the Centers for Disease Control and Prevention (CDC) has now used its emergency pandemic powers under the Public Health Service Act to temporarily halt residential evictions.

Gravel2Gavel Construction & Real Estate Law Blog

Gravel2Gavel Construction & Real Estate Law Blog